News - Is the DeFi Summer 2.0 coming now?

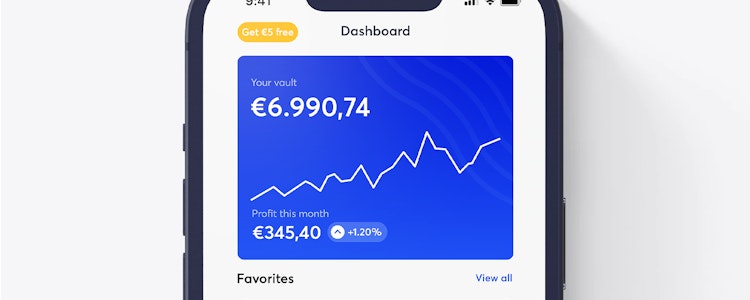

The crypto sector may be on the eve of its DeFi Summer 2.0. The new story: LSTfi - funding with Liquid Staking Tokens.

The Shanghai upgrade of Ethereum has caused a veritable strike boom on the blockchain. Related projects such as Lido-Finance or Rocket-Pool are seeing strong price increases. Meanwhile, the queue for deposits on the Beacon Chain 44 days long. And in the midst of it all, a new industry is celebrating its rise: trading with Ethereum's liquid-staking tokens (LSTs), led by Lido's stETH. Meanwhile, a new DeFi primitief: LSTfi. The emerging strike financing already has a Total Value Locked (TVL) of $400 million and is well on its way to launching DeFi Summer 2.0.

LSTs: returns with real value

Liquid Staking Tokens represent underlying ETH deployed on the Beacon Chain. It is no secret that they are very popular. Almost the half of captured ETH goes to LST protocols such as Lido and Rocket Pool. One reason for this is that they bypass opportunity costs. Investors earn commitment returns and can still use their ETH derivatives for other investments. Moreover, the underlying return is based on Ethereum's Staking Rewards, rather than on particularly inflationary and often worthless utility or governance tokens from smaller DeFi projects. Since the unlocking of Staking Rewards on ETH has caused massive "de-risking," a number of new, innovative protocols are building on the asset, which is increasingly becoming a type of blockchain bond.

One of them is Lybra Finance. On Lybra, users can deposit ETH or stETH and receive the stablecoin eUSD in exchange. It differs from others in that it currently generates about an eight percent return by converting the stake rewards earned through stETH. One US dollar of stablecoin is assumed to be backed by 1.5 times its equivalent value to avoid depegging. More than US$180 million in TVL was generated by Lybra within a few weeks. Lybra's token, LBR, has risen 600% in price over the past three days. So the demand for the stablecoin with passive income is already high and driving insane growth.

No risk, no fun

Another reason for the growing LSTfi sector is probably the demand for leveraged products with the Strike Token. More risk means more return. This market is served by projects like MakerDAO or Asymetrix. Maker already made it possible last year to deposit stETH and take out a loan in ETH to buy more stETH. So with this strategy, returns can be generated in a continuous loop, but it is exposed to possible fluctuations in the ETH exchange rate. In the worst case, users are liquidated and lose their entire position.

Asymetrix, on the other hand, is more like a lottery. All users first pay their stake and the then-generated stake rewards go into a common pool. After a draw, one lucky player wins the full proceeds, while the others leave empty-handed. This allows smaller users to potentially skim larger winnings. Instead of consistently earning four to six percent, returns between 0 and 999 percent are possible for individual strikers. That the stakes should be kept small in all this is already evident from the example of unshETH. The trading platform for LSTs with a TVL of more than US$30 million fell victim to a hack last week and had to freeze assets on the platform. Thus, the "trial-and-error" motto of innovative platforms often poses a risk to users' assets.

unshETH Protocol ( $USH ) was exploited today.

— Nick Ford (@CryptoWithNick) June 1, 2023

Thanks to the team's quick actions they paused contracts and preserved $35M in TVL of $ETH deposits.

The hacker dumped $300K worth of USH, crashing the price -70% before buyers stepped in. This story may have a good ending.

The… pic.twitter.com/bkdj43vWa5

New, innovative and complex

The height of complexity is represented by protocols such as Pendle Finance. At Pendle, users can deposit LSTs and in return receive two new tokens that divide the value of the LST. The PT tokens represent the base value of the tokenized ETH, while the YT tokens tokenize the earned return. Users could thus, for example, keep their ETH and resell only the return earned from the stake. Buyers, in turn, have the opportunity to acquire ETH at a lower price compared to the prevailing market price and can thus make a profit, provided they hold the discounted tokens for a certain period of time. For those who prefer to participate in LSTfi in a more conservative manner, proven DeFi protocols also offer numerous tools. The most recent is Curve Finance, which plans to soon use stETH deposits in addition to frxETH as collateral for its new stablecoin. Or users very classically give their LSTs into a liquidity pool on Uniswap to earn on trading costs.

Regardless, since Ethereum became a full proof-of-stake blockchain early this year, the dams seem to have been broken. The new, innovative earning opportunities are a breath of fresh air in the DeFi sector, which seems to have firmer ground under its feet as a result compared to the DeFi summer of 2020. If crypto prices remain low, more users will likely flock to the new space to fill the upcoming summer hole and provide some much-needed heat.